About Almon Investments

Almon Investments is digital asset management firm that invest in Blockchain tokens, protocols and companies yielding interest for investors globally. Better than a buy and hold strategy, Almon Investments invests in crypto coins with great potentials at the early stage level utilizing a well calculated exit strategy to maximize returns. Almon Investments was founded by Vincent Zhou in 2015, in Beijing, China

Almon Investments Investment launched the first cryptocurrency fund in all of Asia when bitcoin was at $325 /BTC in 2015 and then subsequently launched the first exclusively-blockchain venture fund. In 2017 Almon Investments Investment was the first firm to offer an early-stage token fund. Almon Investments Investment Bitcoin Fund has returned over 144,400% in less than 6 years and has returned billions to its investors.

Almon Investments Investment currently manages over $2.4billion in capital in seven funds in three product groups – passive, hedge, and venture.Almon Investments’s amorphous investment process, where hard numbers are nearly nonexistent, is typical in cryptoland and has so far returned riches having stemmed from turning $20million into $200 million within a year. Its investment in OmiseGO, a crypto platform that provides financial services to unbanked populations, leaped by 33 times after Almon Investments bought coins at $0.27 a pop in mid-2017. It bought tokens in Zilliqa, a platform for speeding up financial transactions, at about nine tenths of a cent per token. Zilliqa traded as high as 20 cents a 567% return. Like other big investors in crypto, Almon Investments is offered “presale” discounts on ICOs to the tune of 30% minimum.

Almon Investments is interested in digital asset management, and has helped raised over $30million, for companies such as OKGold, bloXroute Labs, FTX.Today it counts Silicon Valley venture capital firm Sequoia Capital among its blue-chip investors and is one of the biggest crypto-asset managers in Asia. Almon Investments’s approach has three pillars: Invest like a venture capitalist in initial coin offerings (ICOs), trade on news and events by moving in and out of tokens rapidly and, critically, exploit insider relationships and marketing hype to ensure profitability. The firm’s rise speaks volumes about the anything-goes world of cryptocurrencies, where the stated ideals of democratization are a joke and being an insider is the surest path to riches.

More investment options. More opportunities to grow.

Get access to crypto assets, protocols, hedge funds, crypto companies, and more to stay diversified and ready to take advantage of a wider range of investment opportunities.

138,598

Satisfied Investors

1,000,000

Completed Trades

36

Industry Partners

Our Vision and Mission

- V

To create alternative investment opportunities for individuals who want to attain financial stability and build wealth.

- M

Using our intrinsic value-based investment philosophy to providing investment products and services that offer investors a better way to invest

What We Do

Select Assets

We carefully select financial assets and their instruments, which have a high record of performance, and great future prospects. We then offer these assets to investors.

Trade Assets

We have a team of seasoned traders and market analysts who handle trades on behalf of our investors. Our traders combine analysis from artificial intelligence with human experise.

Manage Assets

We manage these trades on behalf of our investors, provide guidance to them on how to reinvest or plan for future financial security, and generally how to achieve their wealth goals.

Why You Should

choose

Almon Investments

Commission-free trades are everywhere. Smarter investors are here.

Powerful, intuitive platforms for every kind of investor

More investment options. More opportunities to grow.

Knowledgeable support when you need it

Almon Investments provides access to over 74 investment classes. We offer both individual and corporate services with vast growth opportunities./p>

Dynamic trading tools, extensive IT infrastructure make Almon Investments a powerful industry leader. We are self-made, which means flexible.

Almon Investments team is made up of more than 50 IT and finance specialists, each contributing their own expertise to provide the highest quality of service available.

Our security and privacy systems are powered by artificial intelligence, and are designed to detect and disarm any form of threat to our investors funds and assets.

Almon Investments provides investors with knowledge about investments and about how they can take advantage of the financial industry freely, as part of our values.

We also provide a 24/7 live support service to all our investors on our platforms. Our support team is always happy to help with any need you might have.

Request a call

We have investment advisors on ground, ready to call you and offer financial advice to you. Request a free call today.

Our Leadership

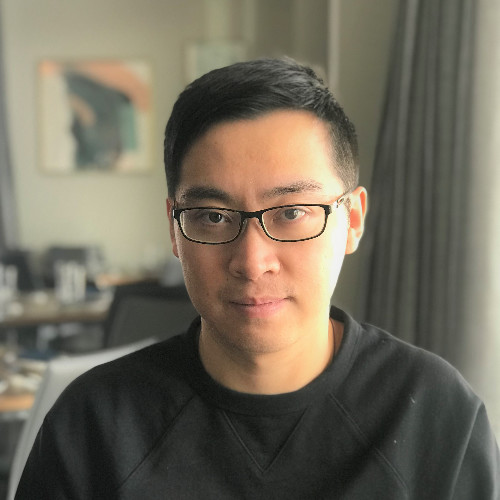

Vincent Shuoji Zhou

Vincent Shuoji Zhou, Almon Investments Founder, is a Chinese Cryptocurrency technology entrepreneur with extensive experience in digital assets trading and investment. Zhou worked in Beijing as an IT consultant for IBM and then Oracle, and in 2014, he committed $10,000 of his savings to trade bitcoin.The next year, he left Oracle to trade crypto full-time and increased his stash to nearly $20,000,000. Zhou is also an early investor of a broad spectrum of blockchain companies and projects. He is well recognised as one of the most well-connected and visionary crypto hedge fund managers in Asia. In 2015, Zhou set off to start his own hedge fund to manage -Blockchain based Cryptocurrency technologies. The fund received more than $200 million from investors like Sequoila Capital, Abstract Ventures, Alexander Pack, Pantera Capital, and Union Square Ventures, among others.

-

Email: info@almoninvestments.com

Our Team

Jingcheng Li

Managing Director at Almon Investments Newyork,united states

Victor Zou

Managing Director Chaoyang Qu,Beijing,China

庞少波 Shaobo

Director of OTC

Dennis Zhang, CFA

Managing Director | Head of Strategy & Global Markets

Xiao(Leo) Wang, PhD, FRM

Portfolio Manager at Almon Investments

Xiaochen Lin

Quantitative Research and Investing (Cryptocurrency)

Chris, Xiaodan QuanCPA, CGA, CIA, CRMA

CPA, CGA, CIA, CRMAWhat Our Clients Say

Real experiences from real people